Listen to This Article

Gold Prices Hit ₹1 Lakh! Should You Buy or Wait? Here's What You Need to Know

Keywords: gold price in India, why is gold price rising, should I invest in gold now, gold investment 2025, gold price outlook

Gold Hits ₹1 Lakh: A Historic Milestone!

The price of gold in India has crossed the psychological barrier of ₹1 lakh per 10 grams, setting off waves of curiosity among investors, jewellers, and households. Whether you're planning to buy gold for investment, wedding season, or simply curious — it’s time to understand why gold prices are rising sharply in 2025 and what you should do next.

Why Is Gold Price Rising in 2025?

1. Global Uncertainty and Geopolitical Tensions

From ongoing Middle East instability to US-China trade tensions, investors are parking money in safe-haven assets like gold. The higher the fear in global markets, the more attractive gold becomes.

2. Weak Indian Rupee

India imports most of its gold. As the rupee weakens against the dollar, the cost of imported gold shoots up, driving domestic prices even higher.

3. Central Bank Gold Buying

Major countries including China, Russia, and Turkey have ramped up gold buying to hedge against the dollar, reducing their reliance on traditional reserves and pushing global demand.

4. Low Interest Rates Outlook

With the US Fed and other central banks hinting at rate cuts to stimulate economies, gold becomes more attractive since it does not yield interest but preserves value during inflation.

5. Retail & Digital Gold Demand

Platforms offering digital gold and ETFs have made investing easier for millennials. Combined with traditional buyers, this has spiked demand further.

Should You Buy Gold Now?

If you're a long-term investor, gold can help diversify your portfolio and hedge against inflation. But here are some quick tips:

-

✔ Buy in small quantities, especially during price dips.

-

✔ Prefer digital gold, gold ETFs, or sovereign gold bonds for safety and returns.

-

✔ Avoid panic buying at all-time highs. Wait for market corrections if investing in bulk.

Expert Outlook on Gold Prices

Market analysts suggest that if inflation and geopolitical tensions persist, gold may test even higher levels. However, profit-booking or global peace breakthroughs may lead to short-term corrections.

Major Impacts of Rising Gold Prices

1. Jewellery Industry Faces Slowdown

-

Higher costs mean fewer people can afford to buy gold jewellery, especially during wedding and festive seasons.

-

Jewellers may see a drop in sales volume or switch to lighter, more affordable designs.

2. Investment Behavior Shifts

-

Investors may move more capital into gold as a safe-haven asset, especially during inflation or stock market volatility.

-

However, retail investors might hesitate to enter at high prices, waiting for a correction.

3. Pressure on Trade Deficit

-

India imports most of its gold. Rising prices increase the import bill, worsening the current account deficit.

-

This, in turn, may weaken the rupee further, creating a vicious cycle.

4. Impact on Inflation

-

Higher gold prices can indirectly contribute to inflation, especially in sectors like luxury goods, weddings, and traditional gifting.

-

This reduces purchasing power, especially among middle-class consumers.

5. Monetary Policy Challenges

-

As gold becomes more attractive than bank savings or bonds, it may affect liquidity in the banking system.

-

Central banks might struggle to balance inflation control and economic growth.

6. Accessibility Issues

-

For students or middle-income individuals looking to invest or gift gold, the rising prices may push them toward alternative assets like silver or digital gold.

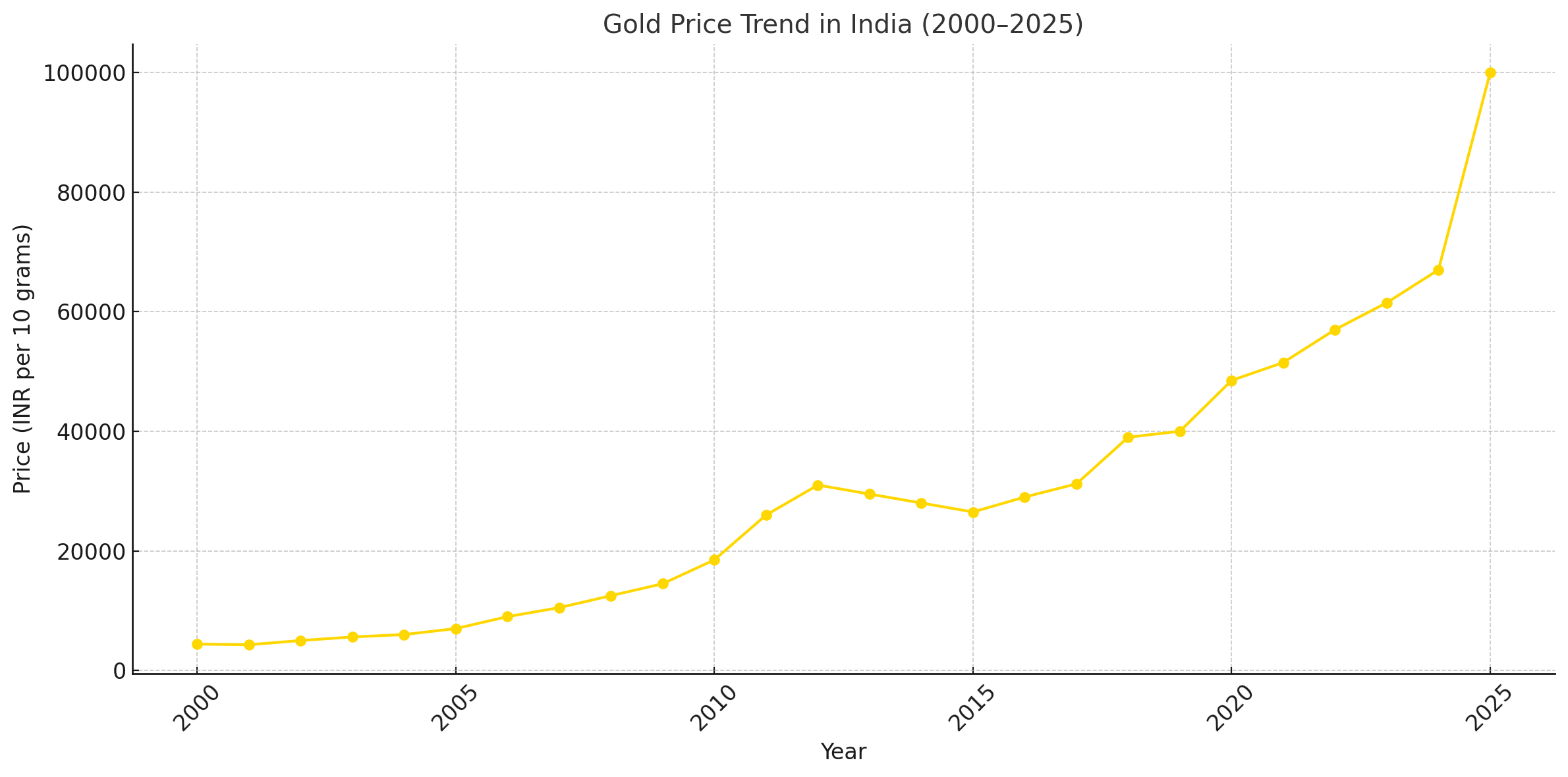

Here is a comparison of gold prices in India from the year 2000 to 2025 (in INR per 10 grams). The chart above visually illustrates the consistent upward trend, especially after 2019.

Gold Price Table (2016–2025)

| Year | Gold Price (INR per 10g) |

|---|---|

| 2016 | 29,000 |

| 2017 | 31,200 |

| 2018 | 39,000 |

| 2019 | 40,000 |

| 2020 | 48,500 |

| 2021 | 51,500 |

| 2022 | 57,000 |

| 2023 | 61,500 |

| 2024 | 67,000 |

| 2025 | 1,00,000 (Projected) |

Impact of Rising Gold Prices on the Stock Market

1. Investor Sentiment Shifts to Safe-Haven Assets

-

When gold prices rise significantly, it often reflects uncertainty in the markets (inflation, war, recession fears).

-

Investors pull money out of stocks (especially riskier ones) and park it in gold, considered a "safe-haven".

2. Equity Market May See Outflows

-

Institutional and retail investors might reduce their stock holdings and invest more in gold or gold ETFs.

-

This can lead to corrections or slowdowns in certain market segments.

3. Banking & NBFC Stocks Under Pressure

-

As people invest more in gold, less capital flows into savings accounts, fixed deposits, or bonds.

-

Banks and NBFCs may see reduced liquidity or higher competition for funds, affecting their stock performance.

4. Jewellery and Retail Stocks May Decline

-

Companies in the jewellery, wedding, or luxury goods sector may struggle as high gold prices reduce consumer demand.

-

Stocks like Titan, Kalyan Jewellers, etc., can see temporary dips.

5. Mining and Commodity Stocks May Benefit

-

On the flip side, companies involved in gold mining or commodities trading might experience a surge in stock value due to higher margins and profitability.

Summary:

-

Rising gold prices usually reflect a risk-off mood in global markets.

-

They often negatively affect high-risk or consumer-facing stocks and positively impact commodity or defensive sectors.

Unlock Your Savings Today!

Unlock Your Savings Today!

Get the best deals with unbeatable service and exclusive offers.

You May Also Like - More to Explore

6 Min Read Time

1.9k ViewsiPhone 17 Launch: Prices in India, USA & Dubai | Launch Date, Camera Comparison & Key Features

Apple is all set to launch its much-awaited iPhone 17 series this year, and tech enthusiasts across the globe are buzzing wit... Explore More

Pallavi Singh

2025-05-24

Pallavi Singh

2025-05-24

7 Min Read Time

1.9k ViewsIndia’s Biggest Electric Bus Drive Begins | 14,028 Buses, ₹10,900 Crore Plan Unveiled

India has taken a significant leap towards cleaner urban transportation with the launch of its largest-ever electric bus init... Explore More

Pallavi Singh

2025-05-24

Pallavi Singh

2025-05-24

Grow Your Business with Proven Digital Marketing

Grow Your Business with Proven Digital Marketing

Ready to attract more customers and outshine your competition? Our tailored digital marketing strategies help you rank higher, generate qualified leads, and build a brand people trust. Let’s take your business to the next level.

Digital Marketing Solutions in Leading Cities

Digital Marketing Company in Ambala - SEO, Google Ads, social media marketing

Looking for the best digital marketing company in Ambala? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Company in Laxmi Nagar | Quantam Minds

digital marketing Company in Laxmi Nagar by Quantam Minds. Boost your business with SEO, social media, ads & more. Get results-driven strategies! Explore This Service

Digital Marketing Service in Connaught Place – Quantam Minds

Boost your business with expert digital marketing services in Connaught Place. SEO, social media & Google Ads by Quantam Minds. Affordable & results-driven. Explore This Service

Digital Marketing Agency in Saket – Quantam Minds

Get affordable, result-driven digital marketing Agency in Saket. Quantam Minds offers SEO, social media, and Google Ads to boost your business growth. Explore This Service

Digital Marketing Services in Rohini

Enhance your business visibility and growth with expert digital marketing services in Rohini. Specializing in SEO, social media marketing, and Google Ads. Explore This Service

Digital Marketing Service in Karol Bagh – Quantam Minds

Get affordable and result-oriented digital marketing service in Karol Bagh. Boost your business with SEO, Social Media, and Google Ads solutions. Explore This Service

Digital Marketing Service in Pitampura – Boost Your Local Business

Drive business growth with expert digital marketing service in Pitampura. We offer SEO, social media, and paid ads tailored for local success. Explore This Service

Digital Marketing Service in Janakpuri – Top Digital Marketing Agency

Get professional and affordable digital marketing service in Janakpuri. Boost your business with SEO, social media marketing, and Google Ads for fast growth. Explore This Service

Digital Marketing Service in Preet Vihar – Quantam Minds

Boost your online presence with result-driven digital marketing in Preet Vihar. From SEO to Google Ads, get complete digital solutions for business growth. Explore This Service

Digital Marketing Service in Nehru Place – Quantam Minds

Drive business growth with expert digital marketing in Nehru Place. Quantam Minds offers SEO, PPC, Social Media, and complete online marketing solutions. Explore This Service

Digital Marketing Service in Mumbai – Quantam Minds

Boost your online visibility with top-rated digital marketing in Mumbai. Get complete solutions like SEO, Google Ads & Social Media by Quantam Minds. Explore This Service

Digital Marketing Service in Lucknow – Quantam Minds

Boost your business online with expert digital marketing in Lucknow. SEO, PPC, social media & content solutions tailored for local growth by Quantam Minds. Explore This Service

Digital Marketing Service in Chennai – Quantam Minds

Drive growth with expert digital marketing in Chennai. From SEO to social media, get customized digital marketing services by Quantam Minds for your business success. Explore This Service

Digital Marketing Service in Bangalore – Quantam Minds

Boost your online presence with expert digital marketing in Bangalore. SEO, Google Ads, social media—get complete growth solutions for your business. Explore This Service

Digital Marketing Service in Kolkata – Quantam Minds

Boost your business with expert digital marketing in Kolkata. From SEO to social media, Quantam Minds helps you grow online in key areas like Salt Lake, Park Street & Rajarhat. Explore This Service

Digital Marketing Service in Ahmedabad – Quantam Minds

Scale your business online with expert digital marketing in Ahmedabad. Quantam Minds specializes in SEO, PPC, and social media marketing in GIFT City, SG Highway, and Prahladnagar. Explore This Service

Digital Marketing Service in Jaipur – Quantam Minds

Boost your online presence with expert digital marketing in Jaipur. Quantam Minds offers SEO, social media, and PPC services in key areas like Vaishali Nagar, MI Road, and Jagatpura. Explore This Service

Digital Marketing Services in Indore – Quantam Minds

Get top-rated digital marketing services in Indore. Quantam Minds helps you grow online through SEO, social media, and PPC across Vijay Nagar, AB Road, and Palasia. Explore This Service

Digital Marketing Services in Kochi – Quantam Minds

Grow your business with the best digital marketing agency in Kochi. Quantam Minds offers SEO, social media marketing, PPC, and more for startups & enterprises. Explore This Service

Digital Marketing Services in Ludhiana – Quantam Minds

Boost your business with the best digital marketing agency in Ludhiana. Quantam Minds offers SEO, social media marketing, PPC, and more for local and global success. Explore This Service

Digital Marketing Services in Bhopal – Quantam Minds

Grow your Bhopal business with Quantam Minds, a top-rated digital marketing company in Bhopal. Get expert SEO, social media, PPC & more. Explore This Service

Digital Marketing Company in Jabalpur – Quantam Minds

Grow your Jabalpur-based business with the best digital marketing agency in Jabalpur. Quantam Minds offers SEO, PPC, social media, and more for startups & enterprises. Explore This Service

Digital Marketing Company in Gwalior – Quantam Minds

Boost your brand with the best digital marketing company in Gwalior. Quantam Minds offers SEO, PPC, and social media marketing for startups and enterprises. Explore This Service

digital marketing company in Ujjain – Quantam Minds

row your business with the best digital marketing agency in Ujjain. Quantam Minds offers SEO, PPC, social media marketing & local SEO services. Explore This Service

Digital Marketing Agency in Gurgaon – SEO, PPC & Social Media Experts

Grow your business online with Quantam Minds – the leading digital marketing agency in Gurgaon offering SEO, PPC, and social media solutions tailored for local success. 🌐✨ Explore This Service

Digital Marketing Company in Faridabad – Quantam Minds

"Looking for the digital marketing company in Faridabad? Quantam Minds offers SEO, PPC, and social media marketing for local business growth. Explore This Service

Digital Marketing Agency in Panipat – Quantam Minds

Looking for a result-driven digital marketing company in Panipat? Quantam Minds offers expert SEO, PPC, local SEO, and full-funnel services to grow your business Explore This Service

Digital Marketing Company in Karnal – Quantam Minds

Partner with Quantam Minds – the top digital marketing company in Karnal. Boost visibility, generate leads, and grow your business with expert SEO and PPC. Explore This Service

Best Digital Marketing Company in Rohtak – SEO, Google Ads, social media marketing

Looking for a digital marketing company in Rohtak? Quantam Minds offers SEO, Google Ads, local marketing, and social media strategies to grow your business Explore This Service

Digital Marketing Company in Hisar – Quantam Minds

Partner with the best digital marketing agency in Hisar. Quantam Minds offers SEO, PPC, lead generation, and branding for local Hisar businesses Explore This Service

Digital Marketing Company in Panchkula – Quantam Minds

Partner with the best digital marketing agency in Panchkula. Quantam Minds offers SEO, PPC, social media marketing, and lead generation for businesses in Panchkula. Explore This Service

Digital Marketing Company in Yamunanagar – Quantam Minds

Grow your business with the best digital marketing Company in Yamunanagar. Quantam Minds offers SEO, social media, PPC, and lead gen services for local success. Explore This Service

Digital Marketing Company in Rewari – Quantam Minds

Partner with the best digital marketing agency in Rewari. Quantam Minds offers SEO, PPC, and lead generation services tailored for Rewari businesses. Explore This Service

Digital Marketing Company in Sirsa – Quantam Minds

Grow your brand with the best digital marketing agency in Sirsa. Quantam Minds offers SEO, PPC, social media, and digital growth services in Sirsa. Explore This Service

Digital Marketing Company in Jind – Quantam Minds

Get expert digital marketing services in Jind by Quantam Minds. Best digital marketing agency in Jind for SEO, PPC, lead generation & online branding Explore This Service

Digital Marketing Agency in kanpur – Quantam Minds

Grow your business online with the best digital marketing agency in Kanpur. Quantam Minds offers SEO, paid ads, and full digital strategies that work. Explore This Service

Digital Marketing Company in Agra – Quantam Minds

Partner with the best digital marketing agency in Agra. Quantam Minds offers SEO, Google Ads, lead generation, and online branding services for Agra businesses Explore This Service

Digital Marketing Company in Ghaziabad – Quantam Minds

Grow your business online with the best digital marketing agency in Ghaziabad. Quantam Minds offers SEO, PPC, social media & full digital solutions Explore This Service

Digital Marketing Agency in Meerut – Quantam Minds

Work with the best digital marketing agency in Meerut. Quantam Minds offers local SEO, social media, PPC & lead generation services tailored for Meerut businesses. Explore This Service

Digital Marketing Agency in Varanasi – Quantam Minds

Grow your business with the best digital marketing agency in Varanasi. Quantam Minds offers SEO, paid ads, local SEO & content marketing solutions. Explore This Service

Best Digital Marketing Agency in Allahabad | Quantam Minds

Looking for the best digital marketing agency in Allahabad ? Quantam Minds offers SEO, Google Ads, and online branding for businesses across Allahabad. Explore This Service

Digital Marketing Agency in Aligarh – Quantam Minds

Grow your business with the best digital marketing agency in Aligarh. Quantam Minds offers SEO, social media, Google Ads & website development for Aligarh businesses Explore This Service

Digital Marketing Agency in Bareilly – Quantam Minds

Looking for the digital marketing agency in Bareilly? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Agency in Ayodhya – Quantam Minds

Looking for the best digital marketing agency in Ayodhya? Quantam Minds offers SEO, Google Ads, social media marketing, and website solutions for local growth Explore This Service

Digital Marketing Agency in Moradabad – Quantam Minds

Looking for the digital marketing agency in Moradabad? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Best Digital Marketing Agency in Saharanpur – Quantam Minds

Grow your business online with result-driven digital marketing in Saharanpur. Quantam Minds helps local brands boost visibility, leads, and sales through SEO, Google Ads, and social media strategies. 📈 Explore This Service

Digital Marketing Agency in Gorakhpur to Grow Your Local Business

Reach more customers in Gorakhpur with expert SEO, social media, and ads. Boost visibility and sales with digital marketing tailored for local growth. Explore This Service

Digital Marketing Agency in Jhansi – Quantam Minds

Looking for the best digital marketing agency in Jhansi? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Company in Surat – Quantam Minds

Looking for the digital marketing agency in Surat? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Agency in Chandigarh – Quantam Minds

Looking for the best digital marketing agency in Chandigarh? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Best Digital Marketing Company in Noida – Quantam Minds

Grow your Noida business online with the best digital marketing company. Get more leads and sales with SEO, PPC, and social media marketing. Explore This Service

Best Digital Marketing Company in Greater Noida – Quantam Minds

Grow your Greater Noida business online with the best digital marketing company. Get more leads and sales with SEO, PPC, and social media marketing. Explore This Service

Best Digital Marketing Company in Pune – Quantam Minds

Partner with the top digital marketing agency in Pune for SEO, social media, and Google Ads that drive growth. Explore This Service

Best Digital Marketing Company in Nagpur – Quantam Minds

Partner with the top digital marketing agency in Nagpur for SEO, social media, and Google Ads that drive growth. Explore This Service

Best Digital Marketing Company in Raipur – Quantam Minds

Grow your Raipur business online with the best digital marketing company. Get more leads and sales with SEO, PPC, and social media marketing. Explore This Service

Best Digital Marketing Company in Ranchi – Quantam Minds

Partner with the top digital marketing agency in Ranchi for SEO, social media, and Google Ads that drive growth. Explore This Service

Best Digital Marketing Company in Patna – Quantam Minds

Looking for the best digital marketing agency in Patna? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Company in Bhubaneswar – Quantam Minds

Looking for the best digital marketing agency in Bhubaneswar? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Company in Guwahati – Quantam Minds

Looking for the best digital marketing agency in Guwahati? Quantam Minds offers SEO, Google Ads, social media marketing, and website development for local businesses. Explore This Service

Digital Marketing Company in Dehradun – Quantam Minds

Looking for the best digital marketing agency in Dehradun? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Company in Haridwar – Quantam Minds

Looking for the best digital marketing agency in Haridwar? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Company in Rishikesh – Quantam Minds

Looking for the best digital marketing agency in Rishikesh? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Company in Amritsar – Quantam Minds

Looking for the digital marketing company in Amritsar? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Company in Jalandhar – Quantam Minds

Looking for the best digital marketing Company in Jalandhar? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Company in Jammu – Quantam Minds

Looking for the best digital marketing agency in Jammu? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses Explore This Service

Digital Marketing Company in Srinagar – Quantam Minds

Looking for the best digital marketing agency in Srinagar? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Company in Vadodara – Quantam Minds

Looking for the best digital marketing agency in Vadodara? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Company in Rajkot – Quantam Minds

Looking for the best digital marketing company in Rajkot? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Agency in Bhavnagar – Quantam Minds

Looking for the best digital marketing agency in Bhavnagar? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Agency in Gandhinagar – Quantam Minds

Looking for the best digital marketing agency in Gandhinagar? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Agency in Anand – SEO, PPC & Social Media Experts

Looking for the best digital marketing agency in Anand? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Best Digital Marketing Company in Jamnagar – Quantam Minds

Looking for the best digital marketing agency in Jamnagar? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Best Digital Marketing in Mehsana – Quantam Minds

Looking for the best digital marketing agency in Mehsana? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Company in Vapi – Quantam Minds

Looking for the best digital marketing agency in Vapi? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Best Digital Marketing Company in Kurukshetra – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Kurukshetra? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Best Digital Marketing Company in Kaithal – Quantam Minds

Looking for the best digital marketing agency in Kaithal? Quantam Minds offers SEO, social media, Google Ads, and lead generation for local businesses. Explore This Service

Best Digital Marketing Agency in Fatehabad – Quantam Minds

Looking for the best digital marketing agency in Fatehabad? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Best Digital Marketing Company in Jhajjar – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Jhajjar? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing in Bahadurgarh – SEO, Google Ads, social media marketing

Looking for the best digital marketing in Bahadurgarh? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Agency in Lajpat Nagar – Quantam Minds

Looking for the best digital marketing agency in Lajpat Nagar? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Best Digital Marketing Company in South Extension – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in South Extension? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Best Digital Marketing Agency in Rajouri Garden – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Rajouri Garden? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Company in Dwarka – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Dwarka? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing agency in Okhla – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Okhla? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Best Digital Marketing Agency in Paschim Vihar – SEO, social media marketing, Google Ads

Looking for the best digital marketing agency in Paschim Vihar? Quantam Minds offers SEO, social media marketing, Google Ads, and lead generation for local businesses. Explore This Service

Digital Marketing Agency in Malviya Nagar – SEO, Google Ads, and social media marketing

Looking for the best digital marketing agency in Malviya Nagar? Quantam Minds offers SEO, Google Ads, and social media marketing for local businesses. Explore This Service

Digital Marketing Company in Patiala – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Patiala? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Company in Mohali – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Mohali? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Company in Bathinda – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Bathinda? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Agency in Hoshiarpur –SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Hoshiarpur? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing in Sangrur – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Sangrur? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Company in Abohar – SEO, Google Ads, social media marketing

Looking for the best digital marketing Company in Abohar? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Agency in Muzaffarpur – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Muzaffarpur? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Agency in Darbhanga – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Darbhanga? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Best Digital Marketing Agency in Bhagalpur – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Bhagalpur? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Agency in Gaya – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Gaya? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Best Digital Marketing Company in Purnia – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Purnia? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing in Begusarai – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Begusarai? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Company in Katihar – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Katihar? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Company in Arrah – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Arrah? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Best Digital Marketing Company in Saharsa – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Saharsa? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Best Digital Marketing Company in Buxar – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Buxar? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Best Digital Marketing Company in Khagaria – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Khagaria? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Best Digital Marketing Company in Banka – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Banka? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Best Digital Marketing Company in Munger – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Munger? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Best Digital Marketing Company in Dehri – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Dehri? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Best Digital Marketing Company in Bettiah – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Bettiah? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Best Digital Marketing Company in Nalanda – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Nalanda? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Company in Sitamarhi – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Sitamarhi? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing in Roorkee – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Roorkee? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Company in Haldwani – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Haldwani? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Company in Rudrapur – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Rudrapur? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Company in Kashipur – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Kashipur? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Company in Nainital – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Nainital? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Company in Almora – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Almora? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Company in Uttarkashi – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Uttarkashi? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Company in Pithoragarh – SEO, Google Ads, social media marketing

Looking for the best digital marketing agency in Pithoragarh? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Company in Tehri – SEO, Google Ads, social media marketing, and lead generation for local businesses

Looking for the best digital marketing agency in Tehri? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Company in Bageshwar – SEO, Google Ads, social media marketing, and lead generation for local businesses

Looking for the best digital marketing agency in Bageshwar? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Company in Champawat – SEO, Google Ads, social media marketing, and lead generation for local businesses

Looking for the best digital marketing agency in Champawat? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Company in Chamoli – SEO, Google Ads, social media marketing, and lead generation for local businesses

Looking for the best digital marketing agency in Chamoli? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Company in Pauri Garhwal – SEO, Google Ads, social media marketing, and lead generation for local businesses

Looking for the best digital marketing agency in Pauri Garhwal? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Company in Bhowali – SEO, Google Ads, social media marketing, and lead generation for local businesses

Looking for the best digital marketing agency in Bhowali? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses. Explore This Service

Digital Marketing Company in Rudraprayag – SEO, Google Ads, social media marketing, and lead generation for local businesses

Looking for the best digital marketing agency in Rudraprayag? Quantam Minds offers SEO, Google Ads, social media marketing, and lead generation for local businesses Explore This Service

Digital Marketing Agency in Sonipat | Offers website development, SEO, AI optimization, Google My Business optimization

Call +91 7982069569 to connect with a ⭐⭐⭐⭐⭐ digital marketing agency in Sonipat, Haryana. Quantam Minds offers website development, SEO, AI optimization, Google My Business optimization, social media marketing, content creation, graphic design, app development, and software solutions focused on clarity, trust, and long-term business growth. Explore This Service

Disclaimer

Disclaimer

The views expressed by experts in this article are their own and do not necessarily reflect the opinions of any website, organization, institution, or affiliated entity. If you have any concerns regarding this article, please contact us at contact@quantamminds.com and also on WhatsApp

Frequently Asked Questions

Why are gold prices rising in 2025?

Gold prices are rising due to global economic uncertainties, inflation fears, central bank buying, and increased demand from investors seeking a safe-haven asset.

How does high gold price affect the stock market?

It shifts investor sentiment from equities to gold, leading to potential outflows from the stock market and pressure on banking, retail, and luxury goods sectors.

Is it a good time to invest in gold now?

Gold remains a strong hedge during uncertain times. However, investors should assess market trends and risk appetite before investing at peak prices.

What sectors benefit when gold prices rise?

Gold mining companies and commodity-linked businesses often benefit from higher margins when gold prices soar.

Can rising gold prices affect consumer behavior?

Yes, high gold prices can reduce demand in jewelry, wedding purchases, and discretionary spending, especially in countries like India where gold is culturally significant.

ABOUT THE AUTHOR

Ashwani Kumar is a results-driven Digital Marketing Manager at Quantam Minds, specializing in crafting and executing data-driven marketing strategies that drive brand growth and online success. With a strong background in SEO, PPC, social media marketing, and content strategy, Ashwani has a proven track record of increasing brand visibility, generating leads, and optimizing digital campaigns for maximum ROI.

- How to Fix the Black Screen Issue in Adobe Premiere Pro

-

Next